Renters

The Boost renters program is designed as a modular product in order to allow Partners significant flexibility. The multitude of available endorsements, limits and deductibles means that Partners can build an insurance offering that best suits their specific customer base, or that they can opt to let the customer choose from a wide range of available options. Boost has partnered with Markel to make this renters program available to our Partners so it operates slightly differently than other Boost programs.

The Boost renters program is an admitted lines product filed in 47 states and the District of Columbia (not available in Rhode Island, Kentucky or Alaska).

Basic Structure

The renters product is designed specifically for users who occupy multi-family apartment buildings. It can be sold to users in single family homes, but there is a significant discount available to most customers in multi-family dwellings. The product is highly modular and begins with a base form offering renters with either contents and liability coverage (all four coverages below) or liability only coverage (E & F), with many optional endorsements available to enhance the coverage:

- Coverage C - Contents (may require two deductibles - one wind/hail, one all other perils)

- Coverage D - Loss of Use

- Coverage E - Personal Liability

- Coverage F - Medical Payments

Coverage | Limits | Notes |

|---|---|---|

Base Coverage Coverage C - Contents | Available from $10,000 - $40,000 (in $5,000 increments) | |

Base Coverage |

| Yes, we know it's weird that it skips from C to E - sometimes insurance is weird. |

Sublimit | 20% of Coverage C | This coverage is automatic, and not user selectable. It will always default to 20% of Coverage C |

Sublimit for |

| This is part of Coverage E and is not modifiable. This is not included in CT, GA, LA, or VT |

Sublimit |

| This coverage is automatic and not user selectable. |

Sublimit |

| This coverage is automatic and not user selectable. |

Deductibles

- There is a minimum deductible of $250 per policy.

- Available Deductibles:

- $250

- $500

- $1,000

- Includes a $1,000 wind/hail deductible (a wind deductible is not allowed in AR, CT, GA, NY, NJ, or OK)

- New Jersey also has a hurricane deductible equal to the greater of the selected "All other Peril" deductible or 5% of Coverage C

Endorsements

Replacement Cost Coverage

- Amends the Policy Definitions to provide cover for replacement costs vs actual cash value of a loss

- Endorsement is mandatory in MN.

Scheduled Personal Property

- Provides extended coverage up to the Coverage Limits for items listed on the Schedule (full details of the endorsement, including which classes of items can be included in the Schedule, can be found in the linked document)

- Maximum total coverage of $10,000

- No proof of ownership or purchase is required at policy issuance, only if a claim is made

- At the time of claim, the insured must provide:

- An appraisal less than 3 years old

- A bill of sale that shows a complete description of the item

Theft Coverage

- Removes ‘burglary’ from the list of Covered Perils and replaces with ‘theft’

- Endorsement is mandatory in CT, NE, and NH

Water Damage (Sewers & Drains)

- Adds water damage from sewers and drains to the list of Covered Perils

- Matches the Personal Property Limit

Earthquake Coverage

- Adds ‘earthquake’ to the list of Covered Perils

- Has a deductible of 15% of the Selected Coverage C Limit

Identity Fraud Expense

- Adds coverage for loss related to an occurrence of identity fraud

- Available Limits:

- $5,000

- $10,000

- $15,000

Silver, Gold or Platinum Enhancement

- Provides increased coverage limits as outlined in the Enhancement Coverage Comparison page

- These enhancements are not available in FL

Golf Cart Coverage

- Provides coverage for golf carts while used for golfing purposes on a golf course and other transportation off public roads

- Does not cover golf carts used for business

Windstorm or Hail Exclusion (may be used to control aggregate)

- When purchased, this endorsement removes ‘Windstorm and Hail’ from the list of Covered Perils- This endorsement is only available in FL, LA, MS, NC, SC, TX

- If selected, a rating factor of 0.95 is applied (except in FL)

Exclusions

Exclusions to the policy will include, but not be limited to, war or any warlike operation, nuclear hazard, illegal, unlawful, or intentional acts of any insured, loss due to mold.

Preferred Property Discount

The renters program does not include any specific underwriting of the insured. As opposed to making the pool of possible customers smaller via underwriting the Boost product strives to make it more attractive to a set of core users who share common characteristics associated with lower risk. This is made possible through the preferred property discount which provides a significant discount to certain potential customers.

To be eligible for the Preferred Property credit, the property must meet one of the following:

- Lease or rental agreement provisions require residents to have renters insurance

-OR- - Property must be more than 100 units

Clearly, the most simple way to become eligible for the credit is for the customer to be required to have renters insurance. Most Boost Partners will ask this question on their front end and those users who respond in the affirmative will obtain the credit, no proof is required. For customers that do not respond in the affirmative to question 1 it's still possible to obtain the credit.

Policy Term

The policy term is either:

- Monthly Continuous

- Has an initial policy period of one calendar month

- If selected, the policy will remain in effect for successive policy periods of one calendar month unless the required premium is not paid prior to the end of the current policy period

- Annual

- CT and FL policies are annual only (monthly installments are allowed)

Policy Quoting and Issuance

Quote Generation

Coverage for the selected limit is rated on a monthly basis after all details of the address have been answered. If allowable under your product structure and UI, customers can modify various coverage aspects including limits and deductibles to see rating impacts prior to final selection and purchase. The quote will be returned via the Boost API will be the monthly premium, including all applicable taxes and fees. Boost will invoice you on a monthly basis for earned premium (monthly continuous policies) or installment premium (1/12 of written premium for annual policies) from the preceding month.

Policy Issuance

Each policy will be either annual or monthly continuous (with an expiration date of ‘continuous’ on the declarations page). The forms will be shared with you on a daily (Sun - Thurs) basis via webhook or email to be distributed to the insured. Policies purchased prior to 5pm EST will be delivered to policyholders the following business day. Policies purchase after 5pm EST will be delivered to policyholders 2 business days later. You are welcome to send a confirmation email to the policyholder letting them know when they can expect to receive their policy docs.

Policy Modifications

- Policies written on a monthly continuous basis cannot have endorsement activity within the term. All changes (i.e., increase in limits, addition of coverage) will require a new policy number and the term counter restarted at 0.

- For policies written on an annual basis, all changes requiring adjustment of premium will be computed pro rata. Mid-term cancels and endorsements of policies written on an annual basis are allowed. Boost will handle calculations of returned amounts on either a pro-rata or 90% pro-rata basis based on state and type of transaction, while also taking into account minimum earned premium amounts, and pass this to you via the API.

Certificates of Insurance

Certificates of insurance (COIs) allow a renter to show proof of coverage. A COI is intended to prove a policy’s status, provide quick access to its coverage details, reduce exposure to risk, and protect against third-party liability. Boost makes it easy for partners to generate a COI for their customer anytime after coverage is purchased through an API request.

Additional Interests

On the COI, renters have the option to specify anywhere between 0 and 5 additional interests on the policy. An additional interest (sometimes referred to as an interested party or a party of interest) is a third-party who benefits from knowing an insurance policy is in place but does not directly benefit from the coverage. Additional interests that are added to insurance policies should be notified when changes to the policy are made. These changes include policy cancellations, lapses in coverage, renewals, or failure to renew a policy.

Policy Cancellations and Non-Renewals

If a monthly term is chosen, we will return the full premium for any term that is cancelled prior to the first day of that period.

- In GA, MD, MI, MT, NY and VA, if the Company requests to cancel then pro-rata, if the insured requests to cancel then also return pro-rata.

- In all other states, pro-rata cancellations of monthly continuous policies are not allowed as monthly terms are fully earned.

For an annual term, if we cancel the policy, any returned premium will be computed on a pro-rata basis. If you cancel the policy, any return premium will be computed on a 90% pro rata basis.

- If the insured requests to cancel, then premium will be returned at pro-rata in AK, LA, MI & MN

- There is no 90% pro rata in CT. Premium will be computed on a pro rata basis if the insured cancels

Monthly continuous policies in the following states cannot be non-renewed except for instances of material misrepresentation or fraud within the time periods outlined below:

- In IL, KS, MO, and WA, a Monthly Continuous policy cannot be non-renewed for a period of six (6) month from the effective date of the first policy period.

- In AZ, CA, and PA, a Monthly Continuous policy cannot be non-renewed for a period of one (1) year from the effective date of the first policy period.

- In NY, a Monthly Continuous policy cannot be non-renewed for a period of three (3) years from the effective date of the first policy period.

Policyholders may cancel their policy, at any time, by notifying you in writing. Policy cancellations are auditable and you must maintain a record of all cancellation requests. This record can be an email, a call, an API log, etc. as long as you are able to provide proof of the request, including the date the cancellation was requested, if and when requested during an audit.

Rater

Coverage for the selected product is rated on a monthly or annual basis, based on the customer's selection. If an annual policy is selected, the API will return the annual premium, which can be charged to the customer in monthly installments. If an annual policy is chosen, all policy and endorsement premiums shall be a whole dollar amount. For this purpose, an amount of fifty (50) cents or more shall be rounded to the next whole dollar. The premium amount generated in the rater is inclusive of all taxes and fees.

Billing

The Program is set up under an Agency Bill construct. You will bill the insured for premium in line with their selected policy term and payment plan (monthly or annual). Each month, Boost will invoice you on a monthly basis for earned premium (monthly continuous policies) or installment premium (1/12 of written premium for annual policies), less your commission, from the previous month, based on the effective date of the policies. Premium for Annual policies can be billed to the policyholder monthly or annually. For policies written on an annual basis, all changes requiring adjustment of premium shall be computed pro rata. A $1 MGA fee shall apply to each payment (except in NH, where the billing fee will not start until month 2).

Minimum Premiums

- If a monthly term is chosen, the premium for each policy period is fully earned on the effective date of the policy period for which the premium has been paid.

- Monthly premium is not fully earned in GA, MD, MI, MT, NY, and VA

- If an annual term is chosen, the minimum written and retain premium of $50 per policy shall apply. The retained premium of $50 shall not apply if termination is initiated by the Company.

- There is no minimum written premium in GA, MI, MN, NH, and VA

- There is no minimum earned premium in GA, LA, MN, NH, and VA

- The minimum premium in MI and SD is $25

Claims

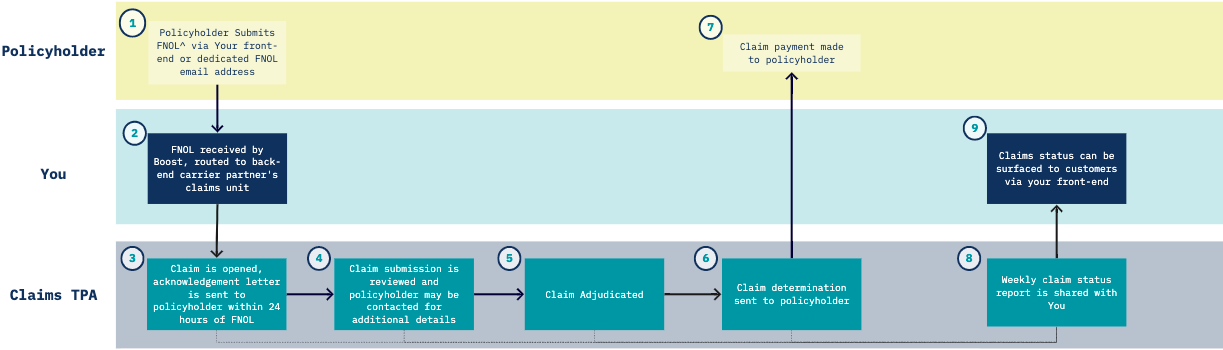

FNOL

Insureds are welcome to report a First Notice of Loss (FNOL) using any of the following methods:

- Via intake form on your platform

- The form output can be shared in the body of an email or attached in a PDF and sent to your dedicated Boost-claims email address (we'll share this with you prior to launch)

- Boost will also provide the option to submit the FNOL output via API in the coming months. More details to follow shortly.

- Directly to Markel via phone (800-236-3113) or email ([email protected])

All FNOL submissions must include the following details:

- Policy number

- Named insured

- Contact info for named insured

- Phone number

- Email address

To help expedite the claims adjudication process, you may also choose to gather the following details:

- Loss location

- Date of loss

- Brief description of loss

- Details of the damage

- The peril that caused the loss (i.e. theft, fire, etc.)

- If submitting a claim for an item included in a Scheduled Personal Property endorsement, you may also want to collect a copy of the receipt or item appraisal

Once FNOL has been received, Markel will send an acknowledgement email to the insured within 24 hours of receipt and may reach out to request additional information to aid in the adjudication process.

Claim Payments

Successful claims will be paid directly to the insured via paper check.

Claim Status

Boost will share a claim status summary document with you on a weekly basis.

Updated about 1 year ago